- Large deliveries in the Orhideea area are estimated starting in 2017, but the success of the area will be decided by the degree of pre-lease achieved by mid-2016;

- The diversification of “fashion” areas with new office offers such as Centru-Nord – Barbu Vacarescu and Centru-Vest Afi, and in the future, Orhideea will lead to a balance of top rents;

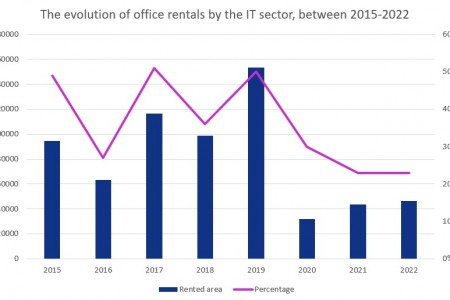

- Demand from IT&C and BPO companies in recent years exceeds 40% of total transactions and has doubled in the last five years;

- What are the nine “assets” of each of the 2 office areas – Barbu Vacarescu and Orhideea;

- The evaluation criteria of these 2 areas: the new stock of offices, deliveries, rent, how fast exits can be made, and the vacancy rate.

According to a study conducted by ESOP Consulting, in 2017, only in the Orhideea area will be delivered class A office spaces with a total area of 93,000 sqm (in the Orhideea Towers, The Bridge projects) and in the entire center-west area (including and Politehnica-Cotroceni area) will exceed 130,000 sqm, as the total stock of deliveries this year in Bucharest. To these will be added future projects, such as the one from Bere Grivita and those that will be realized on the lands recently bought by Skanska and the real estate division of Ikea and which will expand the horizon for the development of the area to 2018-2020.

Although the big deliveries in new and modern buildings announced for the Orhideea area will be made only in 2017, the pre-contracts are negotiated during this period. The success of this area will take shape by the summer of 2016. An important word to say will be IT&C and outsourcing companies, which are estimated to need another 70,000 Romanian employees in the next five years.

In the last five years, the demand from IT&C, Telecom, and BPO companies has grown steadily, from 40,329 sqm total in 2011, to over 100,000 sqm per year, which is constant in the last four years.

“The Grozavesti-Orhideea area is in the spotlight and will be in direct competition with the recently developed office areas in Bucharest, Barbu Vacarescu – Floreasca and Dimitrie Pompei, in the next 9-12 months, to win the interest of the tenants. We believe that this area has competitive advantages that will help it in this fight, the most important of which are: the proximity of the Politehnica and the Regie-Grozavesti university campus, an important thing considering that over 40% of office demand in 2014 and the first 9 months since 2015 comes from companies with this profile, as well as the proximity of the subway and Drumul Taberei – Militari, some of the largest residential neighborhoods in Bucharest “, says Alexandru Petrescu, Managing Partner at ESOP Consulting | Corfac International.

Strengths of the Orhideea area – West Center

- Politehnica and university campus, easy access to other faculties: in the conditions of increasing competition on the labor market, it is especially vital for IT&C companies to have almost as large a student base as possible to recruit the workforce;

- more land available in the area for future construction, an area where a great player like Skanska could be successful with the first developments, could decide to further develop in this area and be followed by other big developers;

- in the period 2016-2019 it will have the most extensive stock of new buildings, due to a large number of announced projects, high-performance buildings, of some international developers – green buildings, quality finishes, modern architectural solutions, etc .;

- proximity to the large “bedroom” neighborhoods Militari and Drumul Taberei, where employees live;

- Afi Mall Cotroceni nearby, one of the largest and most successful malls in Bucharest and Carrefour Orhideea;

- Botanical Garden and Cismigiu Park nearby;

- Old Town nearby;

- Cotroceni residential area, for ex-pats;

- Grozavesti, Semanatoarea, Politehnica metro stations.

Strengths for Barbu Vacarescu – North Center area

- branding as a high office area, has a great popularity, due to the high standards it has built in recent years;

- currently has the most extensive stock of new, state-of-the-art buildings at very high-quality standards (mostly delivered offices in 2013-2015 or in the process of delivery) that can be quickly available and made by developers international, which come with a guarantee of quality execution of works;

- proximity to the luxury residential area, Pipera and Soseaua Nordului, Primavarii, Dorobanti, Aviatorilor, Floreasca, where expats and company managers live, attracted in these areas by international schools for children and other facilities developed over time;

- proximity to the airport;

- proximity to excellent hotels and restaurants, for business partners, accommodation and four and five-star restaurants for guests from abroad or other essential business partners;

- a green area near Floreasca Park and the proximity to the largest park in Bucharest, Herastrau Park;

- Promenada Mall – a new mall in the heart of office developments;

- a promenade area, socializing for employees;

- Aviatiei metro stations, Dimitrie Pompei.

Deliveries in the Center-West area, Orhideea area

- Orhideea Towers: surface 37,000 sqm; term 2017

- The Bridge: surface 56,000 sqm; term 2017

- Bere Grivita: surface 31,000 sqm; term 2018-2019

Deliveries in the Center-West area, the extended center-west area

- Afi, new phases: surface 33,000 sqm; term 2016;

- Sema New: surface 15,000 sqm; term 2016

The current presentation rents, requested by the owners of class A office buildings in these areas are 15-17.5 euro/sqm/sqm north center and 14.5 -17 euro/sqm/month in the west-central area.

Which side will tip the balance of the tenants’ interest between Grozavesti-Orhideea and Barbu Vacarescu – Floreasca is impossible to predict. Still, the time and the primary evaluation criteria will measure the success that each of the two areas will register in the future. However, IT&C and BPO tenants could have a say in the next five years.

In the long run, however, the main criteria for evaluating the success that could be registered by these areas will be:

- what surface is delivered annually in each area;

- what is the total stock of new office buildings;

- what is the non-employment rate;

- what is the average rent level;

- In which areas will it be possible to make the exits faster and more profitable by the developers?