Growing demand for offices in second tier university cities, an opportunity for developers

Far from the spotlight, the office market in secondary university centers, such as Brasov, Craiova, Targoviste, Galati, Ploiesti, and Sibiu, is beginning to take shape. But will it be a market for big players or small players? Potential tenants also consider the “build to suit” solution.

In 25 years of the market economy, Bucharest has undoubtedly been the star of the office market. In the last 5-7 years, the market in the first three big cities after the Capital and university centers at the same time – Cluj-Napoca, Timisoara, Iasi – has developed significantly. Gradually, however, the available workforce decreased, especially the workforce with specific qualifications, such as IT.

Province, in the footsteps of old Bucharest

At the same time with the development of the office market in the big cities, the market started to grow in the secondary university centers, such as Brasov, Craiova, Sibiu, Galati, as well as in the towns with a population between 150,000-250,000 inhabitants (Targoviste, Ploiesti, Bacau).

“The main factors in the evaluation and choice of cities by companies are primarily the existence of university centers and the demographic criterion (resident population), but in various fields of activity may be of interest other aspects, such as positioning in a specific geographical area or degree knowledge of a particular foreign language – such as German, “says Alexandru Petrescu, Managing Partner at ESOP Consulting at CORFAC International.

Entering such a market of a secondary city or developing a company within it is not easy, especially when the necessary space amounts to 3,000 – 6,000 sqm.

LOW AND IMPROPER OFFER This is due to the limited stock of office space built so far. It is a stock that amounts to values between 18,000 – 35,000 sqm/locality. Also, the structuring of the stock is specific to these markets: small buildings predominate (of the order of hundreds of meters, up to 1,000-1,500 sqm), while more significant buildings are rare (3-5 per city) and have areas relatively small, up to 2,500-3,000 sqm.

“Behind these current crises, there is a real investment opportunity, accessible primarily to local developers, those who have the expertise of that market and can react promptly to build a solution. However, the opportunity is also open to medium-sized developers in large cities, those who know this business of high-class office buildings, i.e., their construction, financing, and rental. For example, our company is currently working on a 5,000 sq m application for a build to suit building in a secondary city, which we believe is an opportunity for experienced developers. We are in talks with several local and Bucharest companies. Interested in this project, but at the same time, we are open to discuss with other developers who want to build a building customized to the needs of a client in the top 100 companies in Romania by turnover “, says Alexandru Petrescu from ESOP.

One of the attractive ways to build sustainable office buildings in the medium and long term in secondary city markets is in projects developed in several phases. Each phase consists of a medium-sized building, adapted to the size of the market (between 4,000-7,000 mp).

The number of students in a city is what determines the size of the office market.

According to the latest data from the National Institute of Statistics (INS), in the academic year 2012-2013, 464,592 students were enrolled in Romania, state, and private. Most, 30% of the total study in state and private faculties in Bucharest, following in the top the university centers Cluj-Napoca with 10.8%, Iasi with 10%, Craiova and Constanta with 5.1%, Brasov with 4, 5% and Sibiu with 3.56%. A city with more students automatically means a more extensive recruitment base for multinational companies looking for cheaper and more skilled labor.

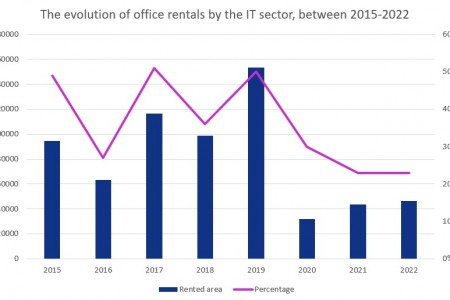

The highest demand for renting office space in student cities comes from IT&C companies, which in Bucharest have had in the last 5 years a share between 32-40% of transactions in the office market. Outside the Capital, the percentage exceeded 55%, according to an ESOP analysis.

IT&C companies primarily recruit graduates or final-year students of technical faculties. According to the latest data from INS, students with a professional profile currently represent only 27.1% of all students studying in Romania, which increases the chances that secondary universities will enter the sights of these companies and implicitly begin to grow the market of offices.

Rents are lower, but not very

In the province, the rents requested by the owners of class A office spaces vary between 12-14 euro/sqm, in the upper-class buildings. Although the level of rent is an important aspect, the cost of office space is not the determining factor in the companies’ current analysis. It has – depending on the industry – a share that varies between 4 and 10% of turnover.

The essential factor in such assessments is the cost of labor, which in some industries may share over 75% of the company’s total costs.

EU funding, the valve through which secondary cities began to breathe

Business support and development centers were of particular importance to these cities: they were a way for local real estate entrepreneurs to initiate, in low-risk conditions, new office building projects.

Build-to-suit, a perspective solution

One of the few alternatives available to large tenants in the current context of secondary cities is the “build to suit” solution, the construction of a custom building based on a pre-lease. Local developers are starting to use such solutions more and more often in discussions with large tenants. We believe that in the short and medium term, this approach is the one that has the highest chances of success in the development of office markets in secondary universities.”, says Alexandru Petrescu, Managing Partner at ESOP.