The Office Market in Bucharest in the 3rd Quarter of 2025

- 10 October 2025

- Real Estate Reports

56,210 sqm leased in Bucharest in Q3 2025 In Q3 2025, modern office spaces with a total area of 56,210 sqm were... Read More

The following ESOP study on the Bucharest office market at the beginning of 2026 examines the current dynamics of the office space sector, which has demonstrated its ability to adapt and remain resilient despite a complex environment shaped by political and macroeconomic challenges.

Download the ESOP study Bucharest Office Market Early 2026

OFFICE STOCK & PIPELINE

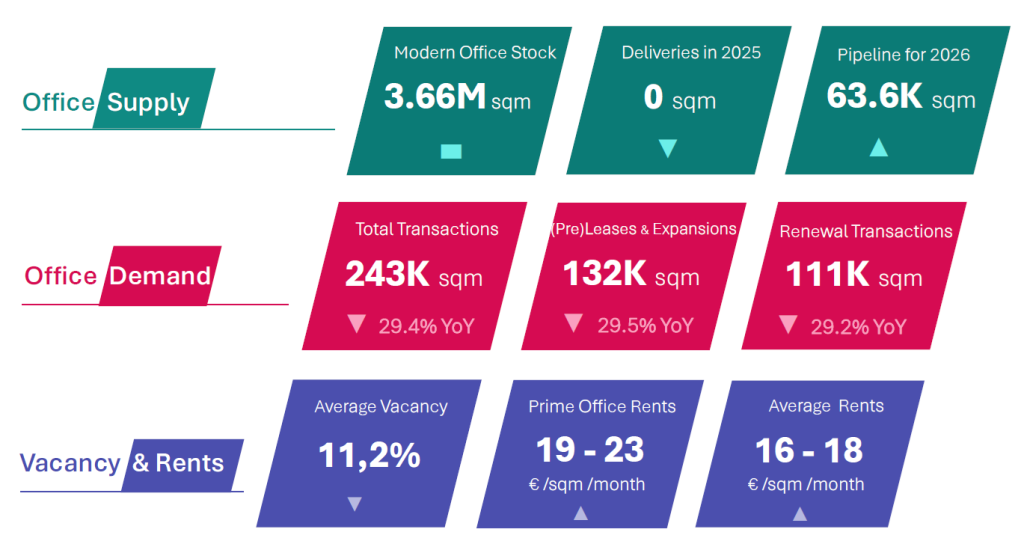

OFFICE STOCK & PIPELINEAt the end of 2025, the office stock of modern, Class A spaces stood at over 3.66 million sqm, totaling 4.21 million sqm when including Class B offices.

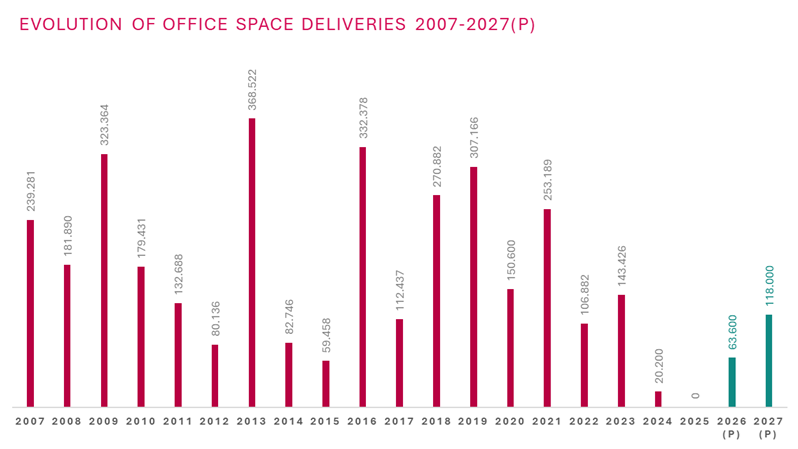

*2025 marks the first year in the past two decades with no Class A office buildings delivered, following a historically low level of just 20,200 sqm completed in 2024.

Three office buildings are scheduled for delivery in 2026, with a combined area of 63,600 sqm: ONE Technology Park (build–to-suit for a single tenant), ARC Project, and ONE Gallery.

More substantial office developments, amounting to 118,000 sqm are scheduled for delivery in 2027.

OFFICE DEMAND & TRANSACTIONS

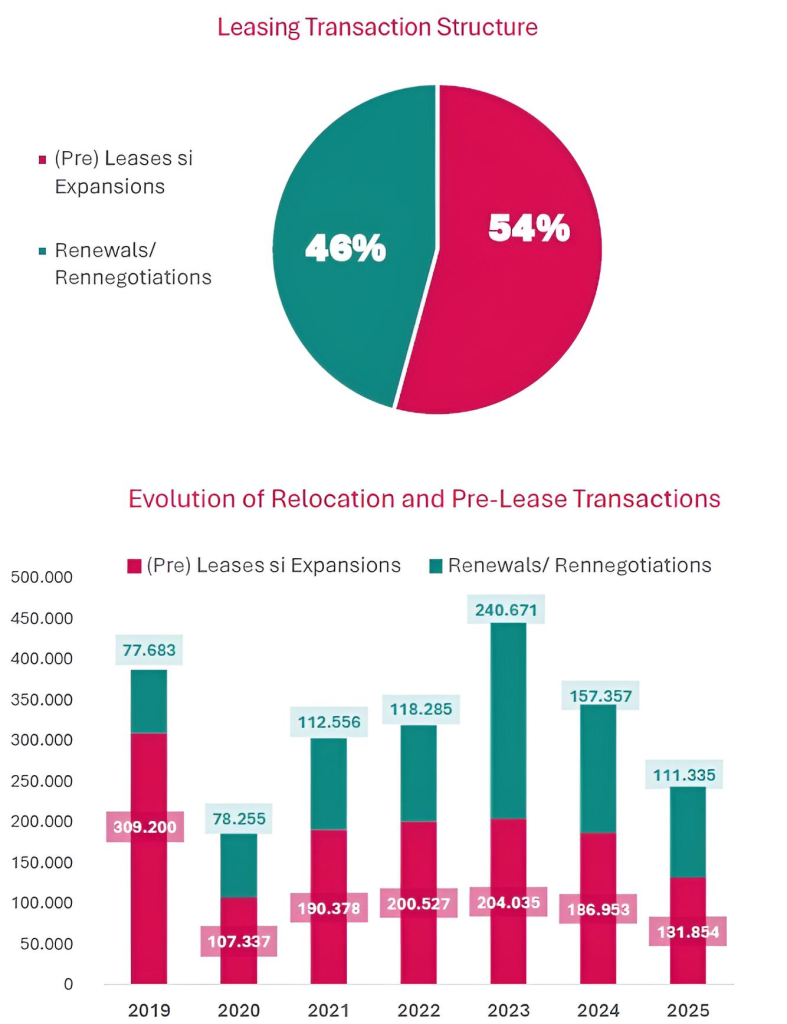

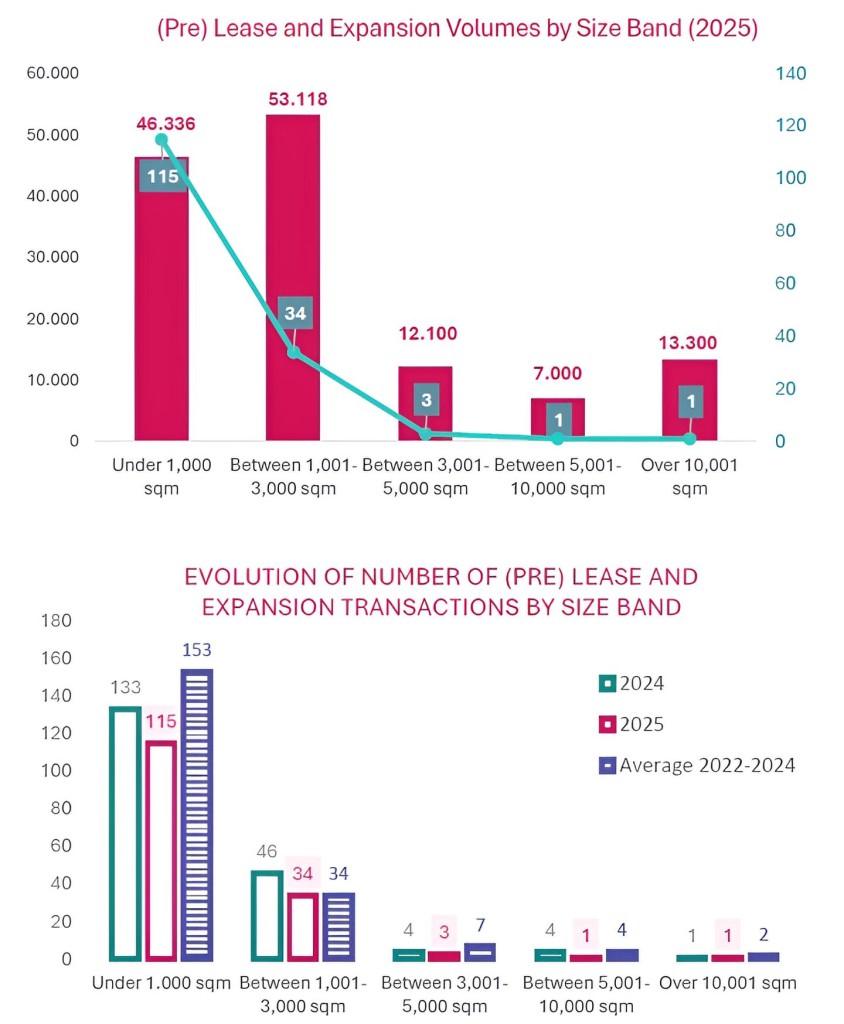

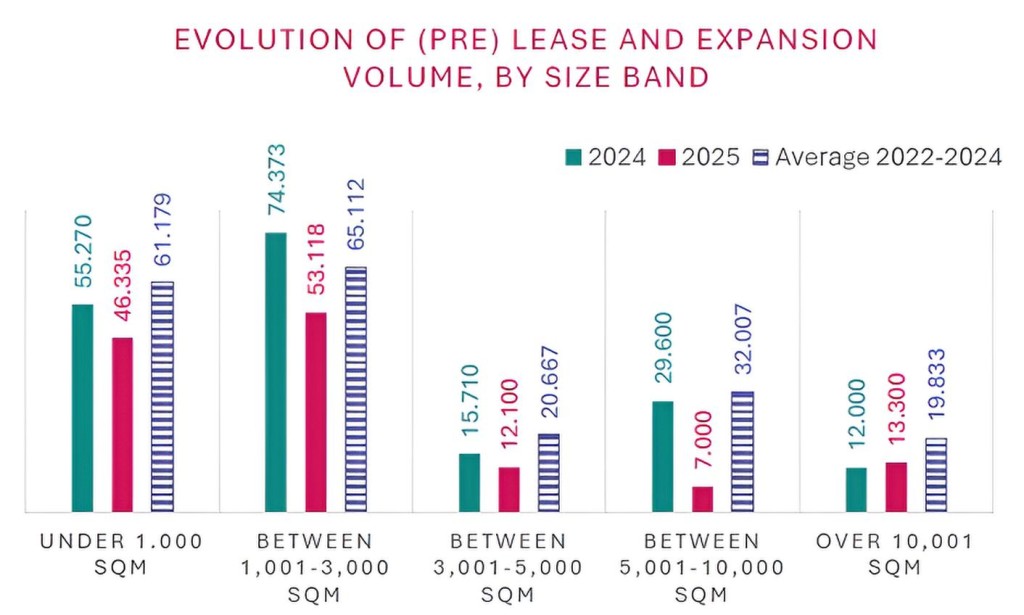

OFFICE DEMAND & TRANSACTIONSIn 2025, total leasing activity exceeded 243,000 sqm, of which approximately 132,000 sqm (54%) was driven by (Pre) Lease and Expansion transactions, while Renewals and Renegotiations accounted for the remaining 111,000 sqm (46%).

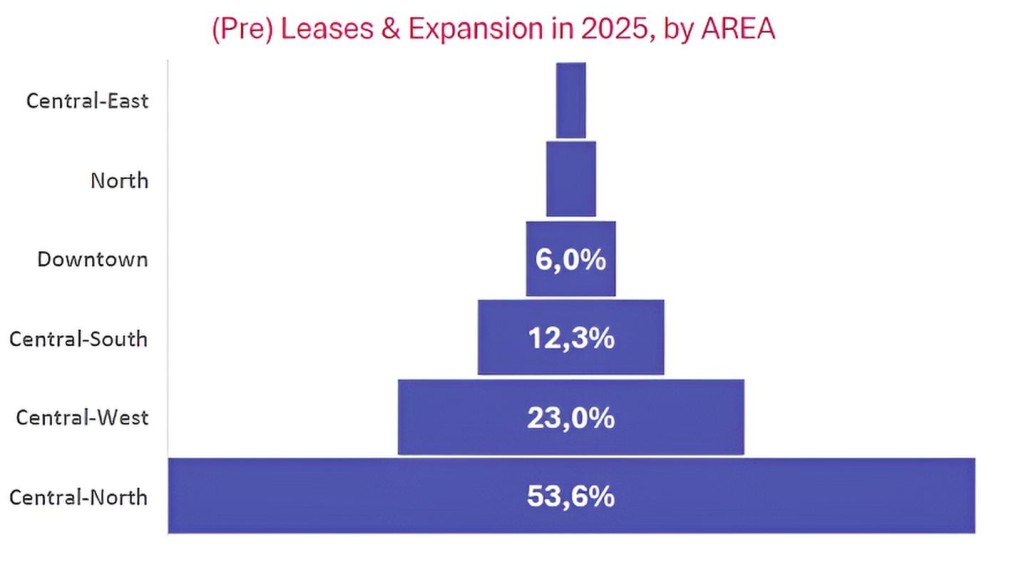

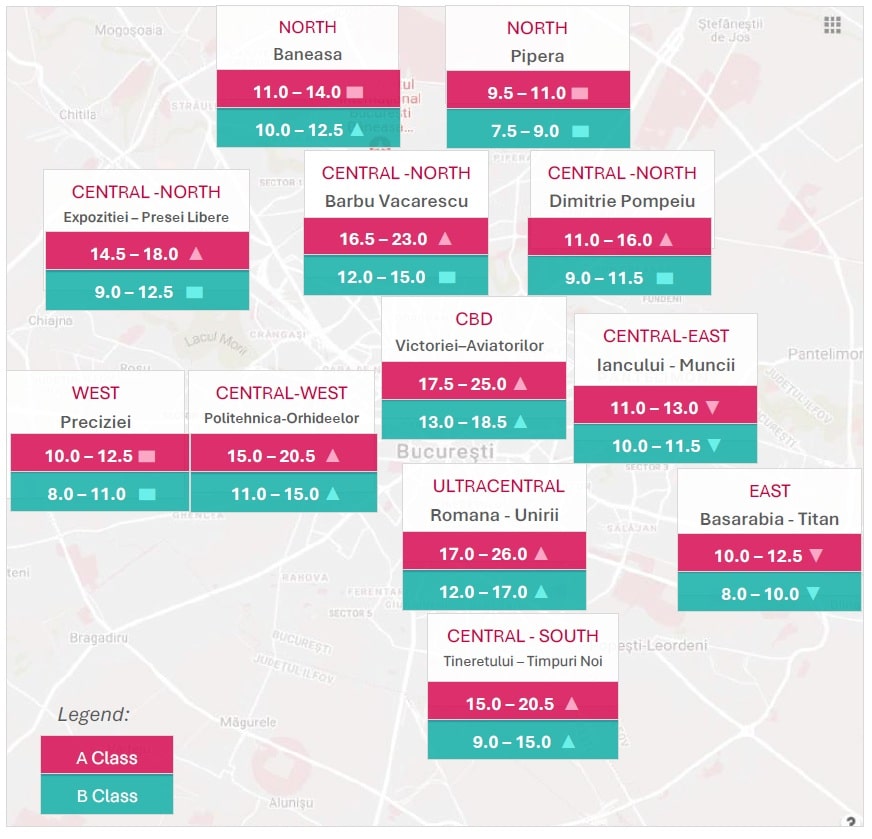

▪ SIZE. While pre-lease and expansion transactions averaged at 855 sqm across 154 deals, renewals and renegotiations involved significantly larger spaces, with an average of 2,783 sqm, despite a substantially lower number of transactions (40 deals). ▪ LOCATION. The most active submarket remained Center-North, accounting for 53.6% of total leased area, followed by Center-West with 23%.

▪ LOCATION. The most active submarket remained Center-North, accounting for 53.6% of total leased area, followed by Center-West with 23%.

In 2025, out of the 154 transactions completed, only 5 exceeded 3,000 sqm, yet these accounted for nearly 25% of the total transacted volume.

Compared with the three-year average, a slight decline is observed across all size segments, both in transactions number and volume, with the most pronounced decrease recorded in the 5,000-10,000 sqm category.

Size segments above 3,000 sqm recorded the strongest contraction, being the most affected by the limited delivery of new office projects over the past two to three years.

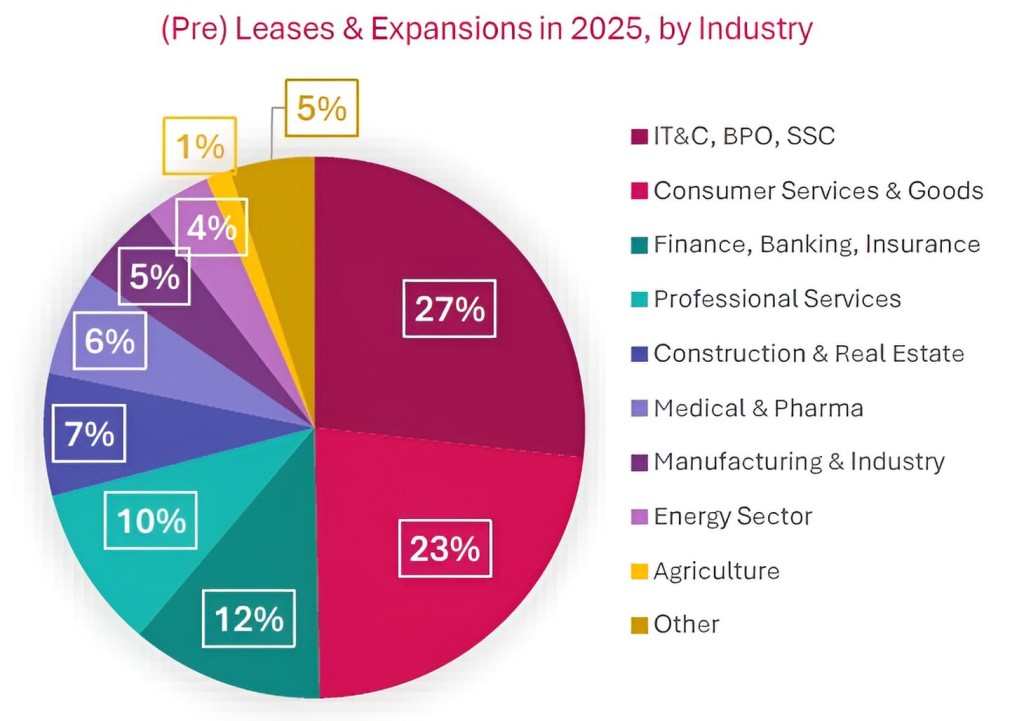

The IT&C, BPO, and SSC sector continues to be the leading industry by activity share in 2025, accounting for 27% of the total transactions.

The IT&C, BPO, and SSC sector continues to be the leading industry by activity share in 2025, accounting for 27% of the total transactions.

Consumer Services & Goods sector ranked second with a 23% share.

The Financial sector placed third, accounting for 12% of total activity.

*The Consumer Services & Goods sector ranked among the top-performing industries for the first time, following a steady increase in activity over the past five years.

| Company | Surface (sqm) |

Project Name | Transaction Type | Industry |

| Adobe | 13,300 | U-Center 3 |

Pre-Lease |

IT & Communication |

| Procter & Gamble | 7,000 | Yunity Park | Lease |

Consumer Goods & Services |

| Transilvania Bank | 4,800 | Green Court |

Expansion |

Financial Services |

| Leroy Merlin | 4,000 | Floreasca Park | Lease |

Consumer Goods & Services |

| Teleperformance | 3,300 | J8 Office Park | Lease |

Professional Services |

| FROO | 2,900 | Hermes Business Campus | Lease |

Consumer Goods & Services |

| Cris-Tim | 2,800 | Oregon Park |

Lease |

Consumer Goods & Services |

| Procredit Bank | 2,500 | Business Garden Bucharest | Lease |

Financial Services |

| Terapia-Sun Pharma | 2,500 | Floreasca Park | Lease |

Medical & Pharma |

Over the past two years, extremely limited new supply (20,200 sqm) has driven the absorption of existing office space and the compression of vacancy rates across most submarkets.

This dynamic, combined with persistent inflationary pressures, has supported continued increases in headline rents for existing buildings across a broader range of properties.

The increase in rents for new projects is driven by factors such as rising construction costs (materials, labor, and energy) and higher financing costs (interest rates), which put pressure on investment budgets.

The delivery of approximately 200,000 sqm in 2026-2027 is expected to support higher transaction volumes over the subsequent 12–18 months.

However, the pace of transactions remains to be seen, as companies continue to navigate a macroeconomic landscape shaped by ongoing changes and challenges.

If you would like more information about the office spaces for rent in Bucharest, please contact the ESOP team by filling this brief form, or by phone (+4) 0723.26.61.97 or (+4) 021.528.04.40. We’ll promptly answer your inquiry!