Bucharest Office Market at the Beginning of 2026

- 28 January 2026

- Real Estate Reports

BUCHAREST OFFICE MARKET – 2025 AT A GLANCE The following ESOP study on the Bucharest office market at the beginning of 2026... Read More

Download the ESOP study – Bucharest Office Market Update at the beginning of 2022

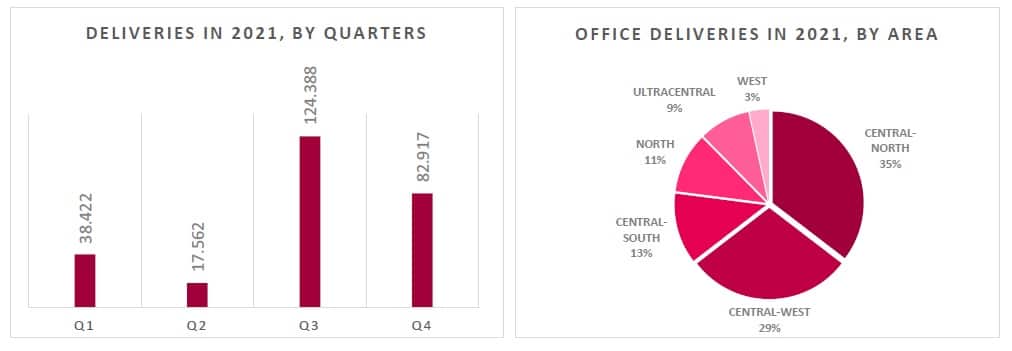

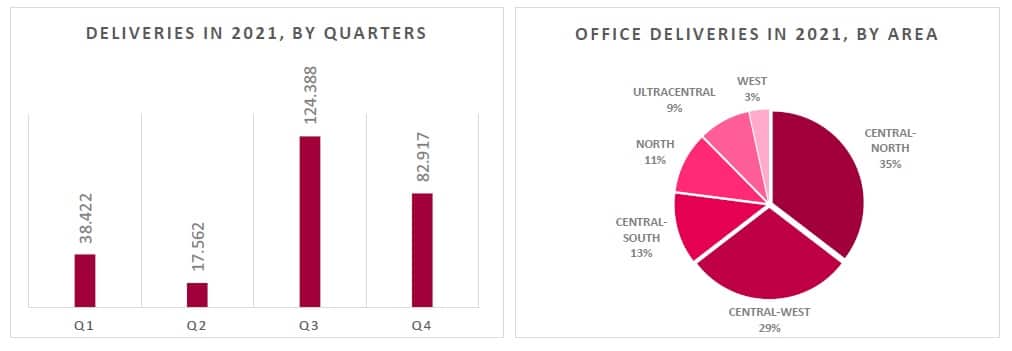

In 2021, 263,000 sqm of new office spaces were delivered in Bucharest, within 14 business centers. This represents a 67% increase compared to the previous year when 157,000 sqm were delivered.

Only 10% of the new supply estimated at the beginning of the year to be delivered in 2021 has been postponed for the following year, a substantially lower percentage than the average of previous years.

Most spaces, over 75% were delivered in the second half of the year, the third quarter registering the highest percentage of deliveries. If at the beginning of 2021, 31% of the expected deliveries were already pre-leased, by the end of the year, this percentage increased to over 70%.

2021 is remarkable for a more balanced distribution in terms of area for the new deliveries. Most of the office buildings delivered in 2021 were located in the Center-North area, with 35% of the total area (decreased from 60% in 2020), and respectively Center-West with 29% of the deliveries (relatively similar with the 24% registered in 2020). A new upward area is the Central-South, with 13%, represented by the U-Center project, Building A. The spaces in multi-building / business park-type projects represented 75% of the deliveries.

| DELIVERY | PROJECT NAME | SURFACE (sqm) | AREA | LOCATION |

| Q1 2021 | Campus 6.2 | 20,600 | CENTRAL-WEST | Grozavesti |

| Millo Offices | 9,600 | DOWNTOWN | Universitate | |

| Q2 2021 | Tiriac Tower | 16,500 | DOWNTOWN | Piata Victoriei |

| Q3 2021 | J8 Office Park – Buildings A and B | 46,000 | CENTRAL-NORTH | Piata Presei |

| U-Center – Building A | 32,800 | CENTRAL-SOUTH | Tineretului | |

| Globalworth Square | 30,800 | CENTRAL-NORTH | Barbu Vacarescu | |

| Politehnica Business Tower | 9,800 | CENTRAL-WEST | Politehnica | |

| Q4 2021 | ONE Cotroceni Park – Phase 1 | 46,000 | CENTRAL-WEST | Cotroceni |

| MIRO | 23,000 | NORTH | Baneasa | |

| Dacia One | 14,000 | DOWNTOWN | Romana |

An increasingly noticeable trend in the design of office buildings is the attention paid by developers to the integration of generous areas of terraces and outdoor courtyards, versatile areas ideal for informal activities.

For 2022 and 2023, projects totaling approximately 286,000 sqm are announced for the time being, but it is possible that this level will increase, in case of new projects receiving the green light.

Approx. 20% of the spaces announced for 2022 are pre-leased already at the beginning of the year.

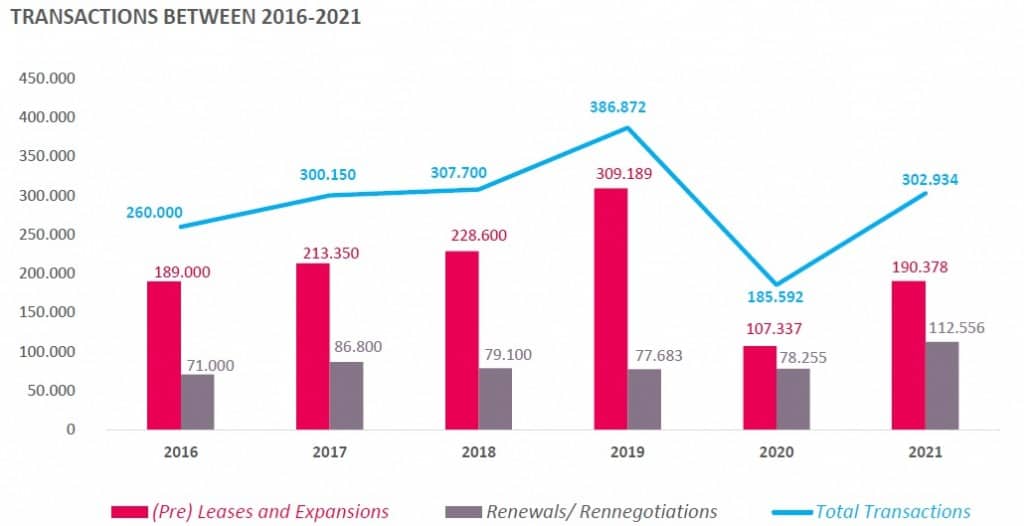

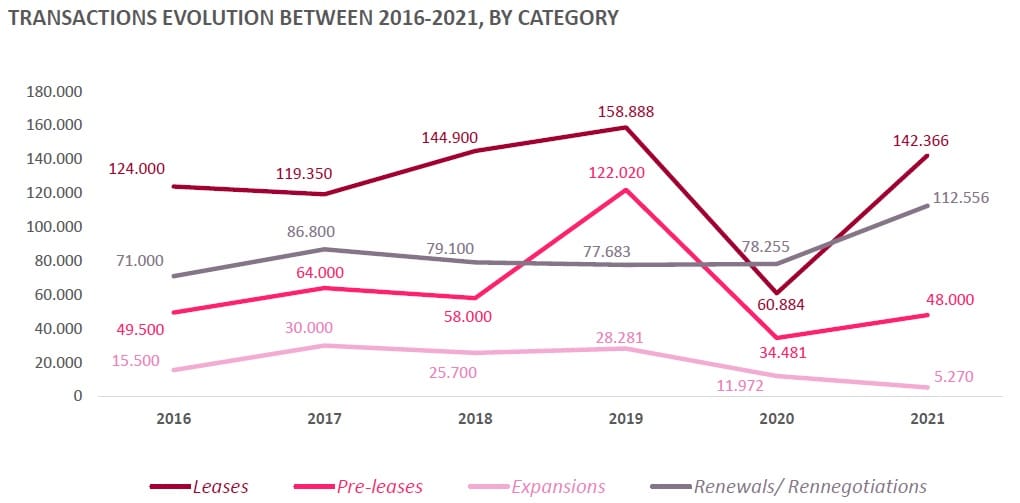

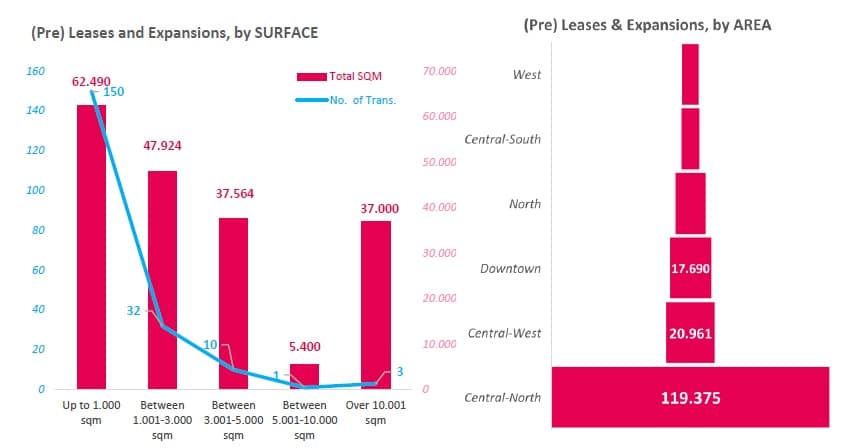

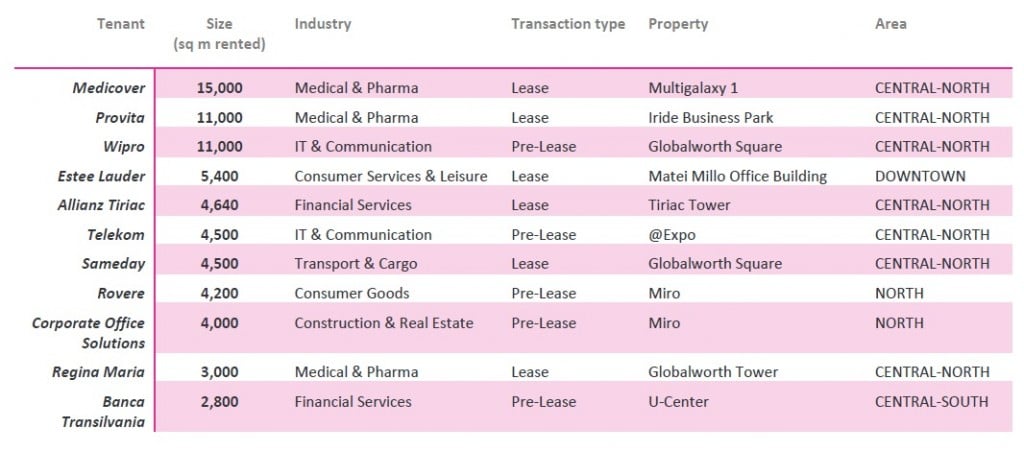

In Bucharest, the volume of spaces traded in 2021 stood at approximately 303,000 sqm. After 2020, when the pandemic caused many companies to suspend their plans to change or expand their headquarters, in 2021 the volume of office transactions returned to the level registered in 2017-2018.

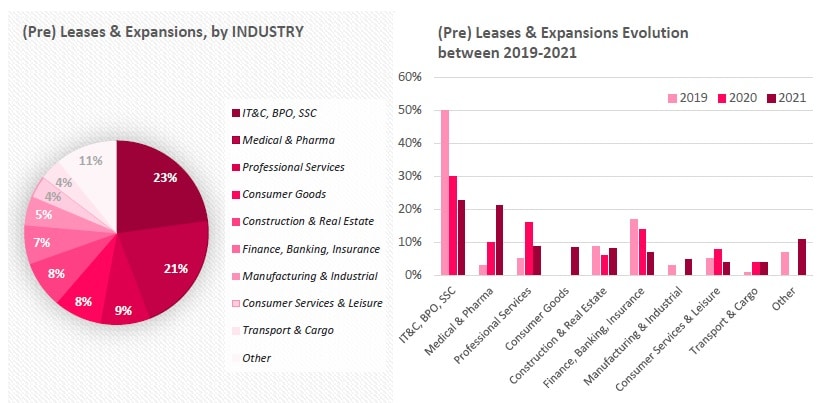

In 2021 the most active companies were those in IT&C, BPO and SSC domain, with 23% of the total volume of transactions.

Yet, compared with the prior 2 years, the IT&C BBO and SSC field registered a constant decrease (50% and 30% in 2019, namely 2020), while Medical & Pharma increased from 3% and 10% in 2019 and 2020, to 21% in 2021, ranking on the second position.

Rent levels remained relatively stable in terms of headline rent while decreasing in net effective terms with up to 1 Euro/ sqm, depending on locations.

The Central-North area was the most stable, and the one registering the most transaction level, as per the available spaces.

B class offices, and especially in less central areas, registered a slight decrease in headline terms.

Service charge levels increased from 3,5-4,0 to 4,0-4,5 Euro/sqm.

Contractual periods got more flexibility, break options being possible to obtain, after 3 years.

More sub-leases registered in 2021, with a total volume of over 4,500 sqm. Yet, this is a small percentage compared to the total available spaces in the market.

The rental terms in these cases were generally 20-25% lower in both headline and net-effective terms. Design investment paid off, the fastest sub-leased spaces being the ones with an impressive fit-out.

ESOP’s portfolio includes, in addition to office buildings for rent in Bucharest, office spaces for sale in Bucharest, industrial parks and warehouses for rent, as well as office spaces for rent in the main cities of the country. If you would like more information, please contact the ESOP team by filling this brief form, or by phone (+4) 0723.26.61.97 or (+4) 021.528.04.40. We’ll promptly answer your inquiry!